Paul B Insurance - Truths

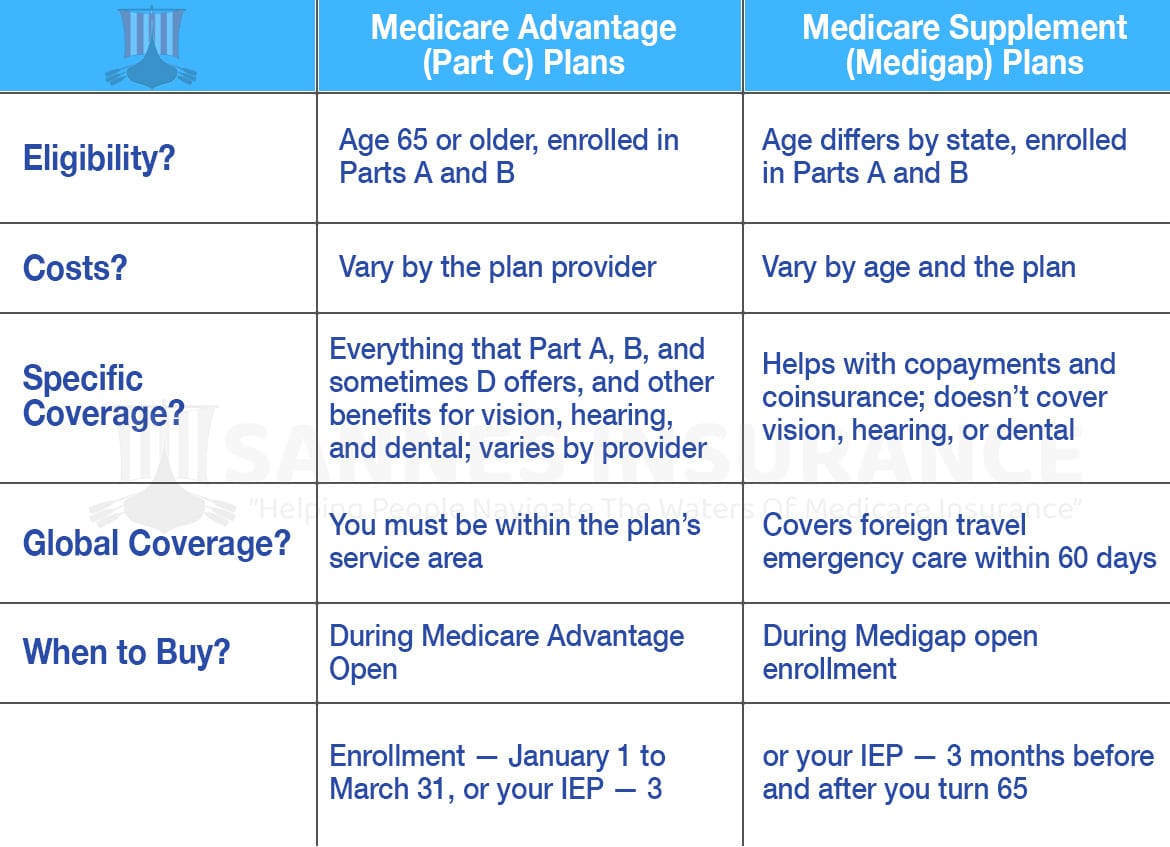

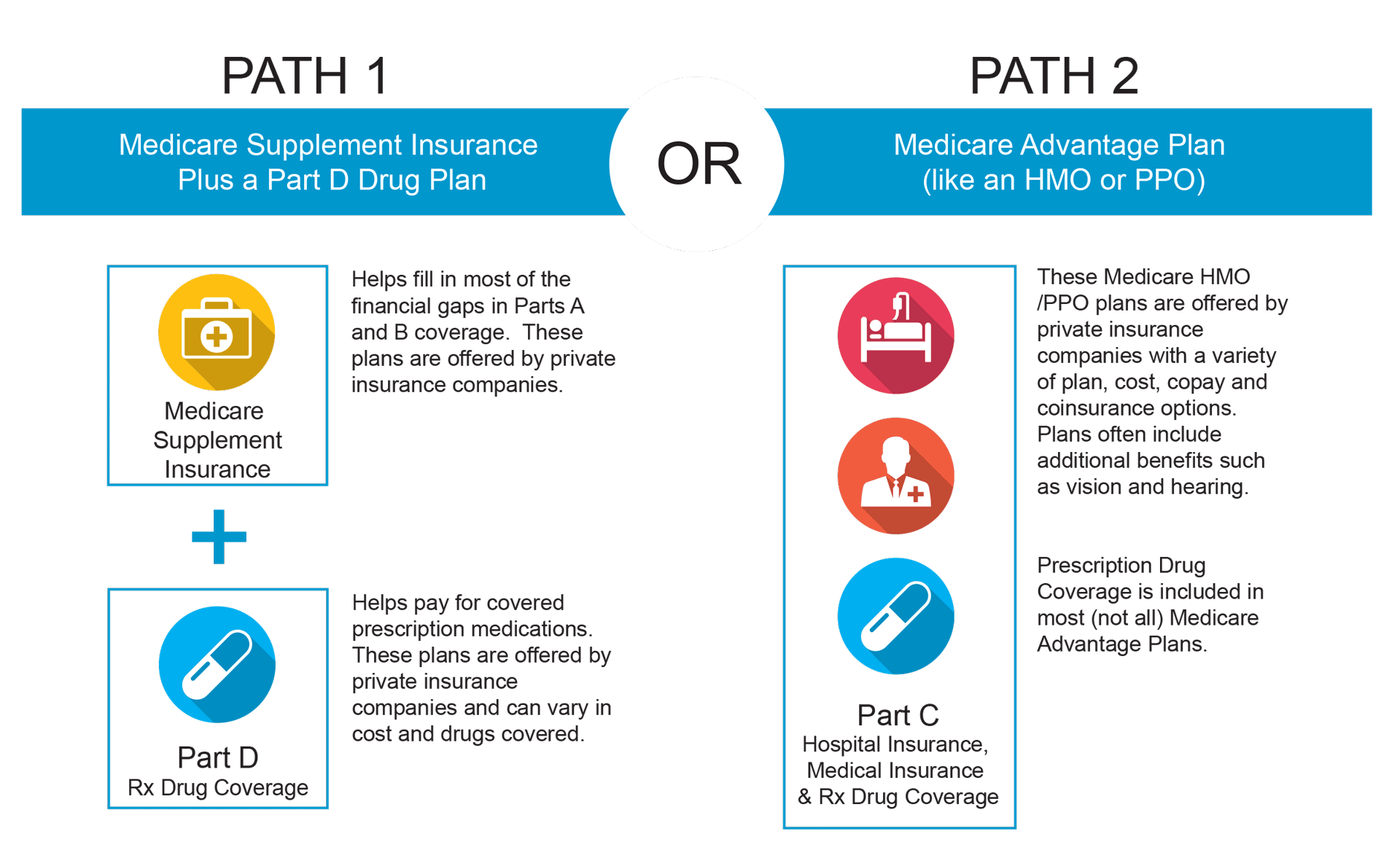

Whether you have a bronze health insurance plan, a high-deductible health insurance, or a Medicare Component C plan, they will certainly all fall under these standard groups first. We'll discuss the primary sorts of health and wellness insurance and also examples. One of two primary kinds of health insurance, public wellness insurance is supplied via a government program, like Medicare, Medicaid, or CHIP.

Just like personal wellness insurance strategies, which we'll speak concerning following, federal health and wellness insurance coverage programs attempt to take care of quality as well as prices of treatment, in an initiative to provide reduced expenses to the guaranteed. All health insurance coverage plans are made to aid you conserve money on wellness care expenses. People with this type of insurance are still responsible for expenses of care, like costs, deductibles, as well as various other out-of-pocket expenditures They may not be as high as with various other types of insurance.

Medicaid and also CHIP are run by each state. While there is no enrollment duration, there are financial needs to qualify. You can obtain started with this state-by-state guide to Medicaid. Find out much more about how medical insurance works. Any type of health coverage that's not gotten via a government program is taken into consideration private medical insurance, the other main sort of medical insurance.

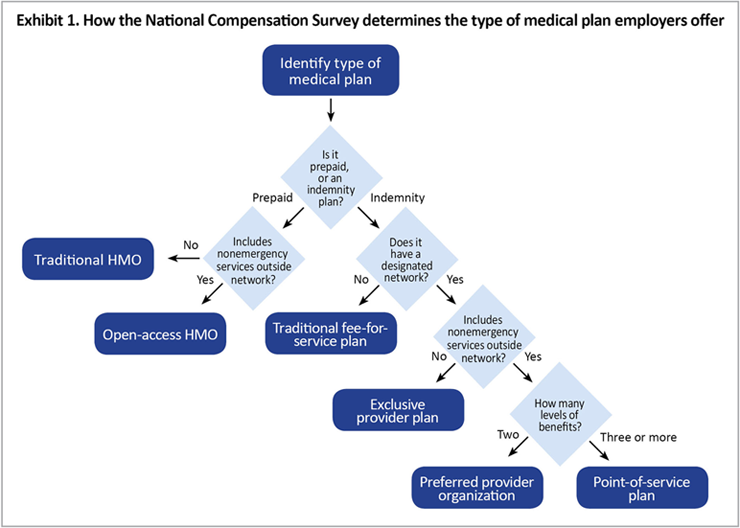

After you've determined the main kind of health and wellness insurance policy based upon its source, you can further categorize your protection by the sort of strategy. Most medical insurance plans are handled care plans, which just means the insurance provider deal with various clinical service providers to develop and also negotiate costs and also quality of treatment.

Get This Report about Paul B Insurance

But the deductibles, and other out-of-pocket prices like copayments and coinsurance for a health insurance plan will certainly vary based on your insurance provider and how much care you seek. A high-deductible health insurance (HDHP), which allows the guaranteed individual to open an HSA account, may be an HMO with one insurance firm, and also an EPO with one more.

Some sorts of wellness insurance coverage, like short-term strategies, do not provide comprehensive insurance coverage as detailed by the Affordable Treatment Act and also hence are not regulated by it either. Short-term medical insurance is ruled out a type of significant medical insurance policy, however only a stopgap action implied to cover a couple of, however not all, clinical expenses. Still, choosing wellness insurance can be hard work, also if you're choosing a plan via your employer. There are a great deal of confusing terms, as well as the procedure forces you to believe tough about your wellness and also your finances. Plus you have to navigate all of it on a due date, typically with just a few-week duration to discover your choices and make decisions.

Asking on your own a couple of basic inquiries can help you zero in on the appropriate plan from all those on the market. Right here are some pointers on where to look and also how to obtain credible guidance as well as aid if you require it. It's not constantly noticeable where to search for medical insurance.

It's funded by both the federal and state governments, yet run by each state, so whether you're qualified relies on where you live. my sources For almost everyone else, the place to go is Healthcare. gov, where you can shop for insurance coverage in the markets produced by the Affordable Treatment Act, likewise referred to as Obamacare.

Rumored Buzz on Paul B Insurance

Even with loads of alternatives, you can narrow things down with some fundamental questions, De, La, O states. If you're rather healthy, any of a range of strategies could function.

In some cases you can go into in your drugs or medical professionals' names while you browse for strategies online to filter out plans that will not cover them. Is my medication on the plan's formulary (the listing of drugs an insurance policy strategy will cover)?

A Health and wellness Upkeep Company tends to have a rigorous network of carriers if you see a service provider outside of the network, the expenses are all on you. A Preferred Carrier Organization "will offer you a whole lot broader choice of carriers it could be a little a lot more pricey to see than an out-of-network supplier, however they'll still cover a few of that price," she discusses.

If you selected that strategy, you 'd be betting you won't have to make use of a great deal of health and wellness services, and also so would just have to bother with your with any luck cost effective premiums, and also the costs of a few visits. If you have a persistent clinical condition or are simply more risk averse, you may rather select a plan that has dialed up the quantity of the costs.

Paul B Insurance Can Be Fun For Anyone

This way, you can go to a whole lot of visits and get a great deal of prescriptions and still have workable month-to-month prices. Which strategies are readily available and also budget-friendly to you will certainly differ a great deal depending on where you live, your income and also that's in your home and also on your insurance coverage plan.

gov or onyour state's ACA insurance policy exchange. Still really feeling bewildered with all the ACA options? You're in luck. he said There is free, neutral expert aid offered to help you choose as well as register in a strategy. Just placed in your postal code at Health care. gov/localhelp and search for an "assister" a person also described as a healthcare navigator on some state websites." Aaron De, La, O is one such navigator, and also keeps in mind that he and his fellow overviews do not deal with payment they're paid by the government.

The internet can be a terrifying location. Corlette says she advises individuals: Do not place your contact details in wellness insurance policy passion types or click on online advertisements for insurance!

"Regrettably, there are a great deal company website of hustler around who make the most of the reality that individuals identify wellness insurance is something that they need to get," claims Corlette. She tells people: "Simply go straight to Medical care. gov. Regardless of what state you stay in, you can experience that site." Any plan you find there will certainly cover the ACA's 10 important advantages such as totally free precautionary treatment and also health center coverage.

Some Of Paul B Insurance

This year, the join duration for the Health, Care. gov market prepares that go right into result in January 2022 begins Nov. 1, 2021 as well as runs up until Jan. 15, 2022. If you're authorizing up for an employer-sponsored strategy or Medicare, the due dates will certainly be various, however possibly additionally in the autumn.

:max_bytes(150000):strip_icc()/terms_i_insurance_FINAL_-3556393b3bbf483e9bc8ad9b707641e4.jpg)